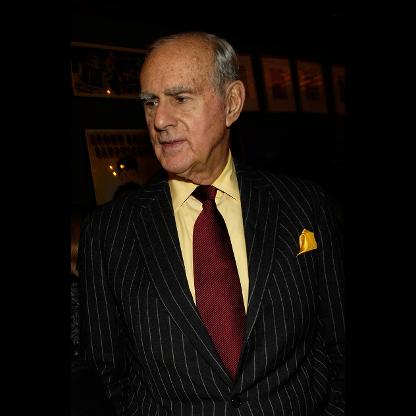

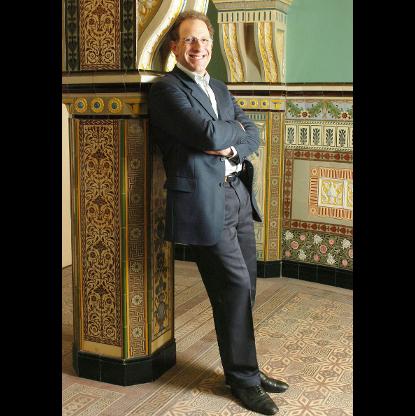

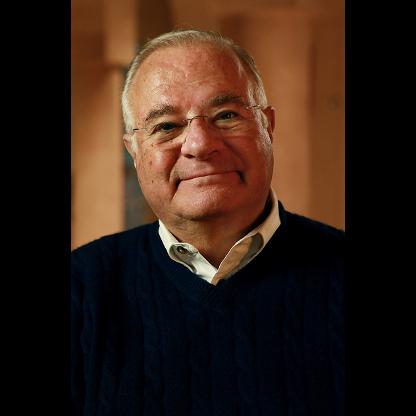

He started his career in 1997, working for Julian Robertson and his hedge fund, Tiger Management. Coleman had grown up with Robertson’s son, Spencer, who lived close to Glen Head, in Locust Valley. In 2000, Robertson closed his fund, and entrusted Coleman with over $25 million to manage, making him one of the 30 or more so-called "Tiger Cubs", fund managers who started their fund management careers with Tiger Management. Fellow Williams graduate Ole Andreas Halvorsen, one of the world's wealthiest hedge fund managers, is another former "Tiger Cub," amongst other very successful hedge fund managers such as Stephen Mandel and Lee Ainslie.