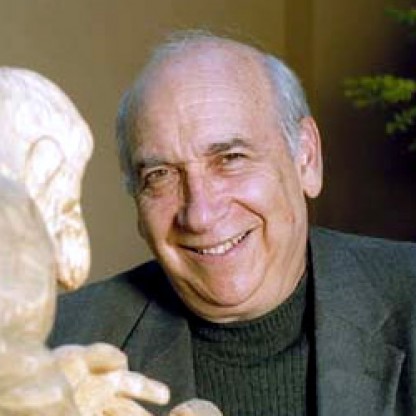

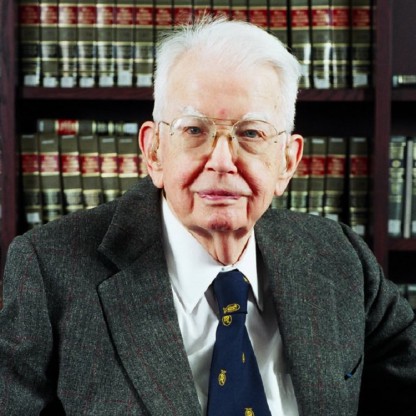

In 1958, at Carnegie Institute of Technology (now Carnegie Mellon University), he collaborated with his colleague Franco Modigliani on the paper The Cost of Capital, Corporate Finance and the Theory of Investment. This paper urged a fundamental objection to the traditional view of corporate Finance, according to which a corporation can reduce its cost of capital by finding the right debt-to-equity ratio. According to the Modigliani–Miller theorem, on the other hand, there is no right ratio, so corporate managers should seek to minimize tax liability and maximize corporate net wealth, letting the debt ratio chips fall where they will.