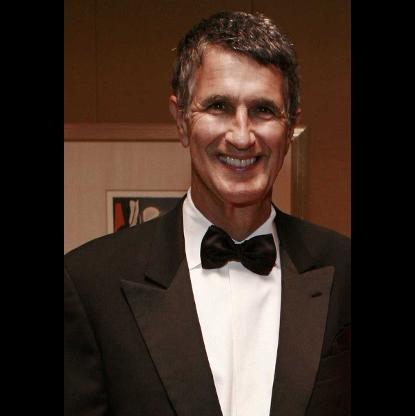

In 1974, Langone left to form a new firm, named Invemed – a venture capital firm. Langone began to study the home improvement Business and eventually bought stock in Handy Dan, a home improvement chain. This led to a relationship with Handy Dan CEO Bernard Marcus and CFO Arthur Blank. Although a minority shareholder, Langone effectively protected Marcus from issues that arose between Marcus and Sanford Sigiloff, the CEO of The Daylin Corporation, Handy Dan's parent company. Marcus, however, felt that if Langone sold his interest in Handy Dan, it might actually improve his relationship with Sigiloff. Shortly after Langone sold his Handy Dan stock both Marcus and Blank were fired. Langone organized financing for Marcus and Blank to found Home Depot. Now a national chain with over 300,000 employees, it is Langone's most notable Business venture.