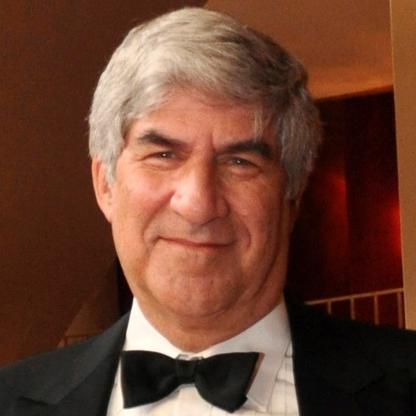

Directly after graduating from Columbia, Cooperman joined Goldman Sachs. He spent his first twenty two years at Goldman in the Investment Research Department as partner-in-charge, co-chairman of the Investment Policy Committee and chairman of the Stock Selection Committee. In 1989, he became chairman and chief executive officer of Goldman Sachs Asset Management and was chief investment officer of the equity product line including managing the GS Capital Growth Fund, an open-end mutual fund, for one and one-half years.